Empower Credit Bureau

Empower Credit Bureau is dedicated to fostering financial inclusion by extending credit access to the unbanked and underbanked populations in Nigeria. Our objective is to harness alternative data sources and traditional financial information to develop comprehensive and accurate credit reports for a broader spectrum of individuals and businesses.

We are laser focused on being a provider of comprehensive and accurate credit reports. Our objective is to foster financial inclusion by extending credit access to the unbanked and underbanked populations in Nigeria. We leverage alternative data sources and traditional financial information to serve a broader spectrum of individuals and businesses. With Smart Customer Acquisition as our section goal, we aim to digitally acquire millions of creditworthy but underserved borrowers, providing them with a frictionless experience and achieving 10x higher disbursal rates.

Femi Olagbaiye (CEO).

Services

Empower Credit Bureau offers innovative credit reporting solutions to extend credit access to the unbanked and underbanked populations in Nigeria. Our goal is to foster financial inclusion by harnessing alternative data sources and traditional financial information to develop comprehensive and accurate credit reports.

Comprehensive Credit Reporting

Our credit assessment services utilize alternative data sources and traditional financial information to create detailed and accurate credit reports, aiding in extending credit access to individuals and businesses across Nigeria.

Credit Assessment Services

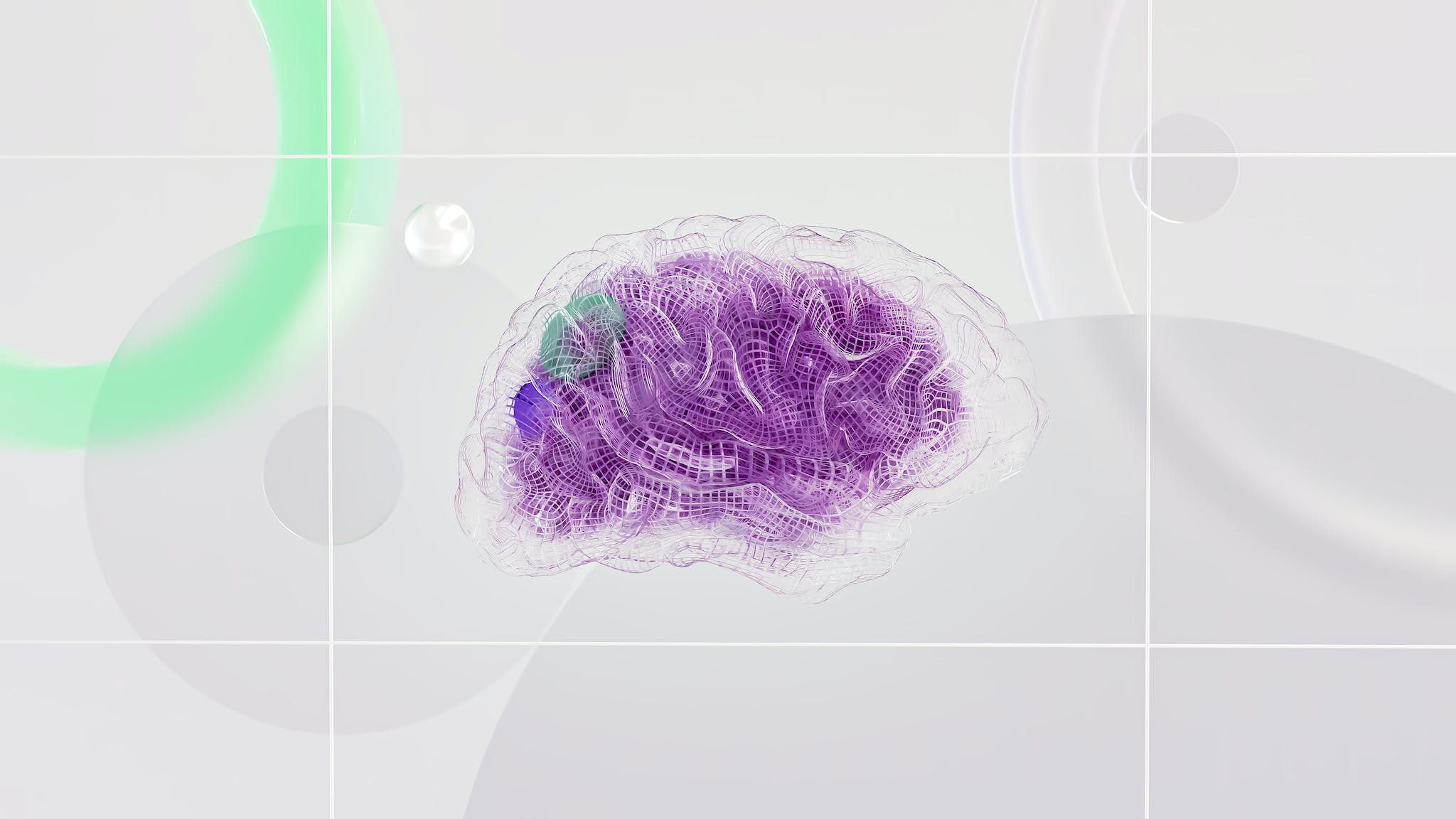

We provide comprehensive credit reporting services, leveraging alternative data sources powered by Artificial Intelligence, Machine learning and traditional financial information to offer accurate and detailed broad viewed credit reports for individuals and businesses, enabling informed lending decisions.

We aim to revolutionize the credit reporting landscape by incorporating alternative data sources such as utility payments, rental history, mobile phone usage, and social media activity into our credit assessment process. This approach will enable a more holistic evaluation of creditworthiness. Credit Risk Mitigation: By using alternative data, we seek to improve the accuracy of credit risk assessment, reducing the perception of high risk associated with the unbanked and underbanked. This, in turn, will encourage financial institutions to extend credit to these segments at lower interest rates and with more favorable terms.

Objectives

Our foremost aim is to promote financial inclusion by developing credit reports for individuals and businesses, incorporating alternative data sources such as utility payments, rental history, mobile phone usage, and social media activity into our credit assessment process. By using alternative data, we seek to improve the accuracy of credit risk assessment, design tailored credit products, engage in financial literacy campaigns, ensure data security and privacy, adhere to regulatory compliance, continuously innovate our credit assessment methodologies, and collaborate with stakeholders to achieve greater financial inclusion.

Vision and Mission

Our vision is to be the leading credit bureau agency in Nigeria, where we facilitate economic growth through inclusive credit reporting. Our mission is to empower individuals and businesses by leveraging alternative data and maintaining data accuracy, security, and regulatory compliance.

Scores

Our objective at Empower Credit Bureau is to foster financial inclusion by extending credit access to the unbanked and underbanked populations in Nigeria. We aim to utilize alternative data sources and traditional financial information to develop comprehensive and accurate credit reports for a broader spectrum of individuals and businesses. With our powerful suite of Big Data and AI-based alternative credit score and fraud score, we are rethinking financial products and tapping into underserved segments to provide equal financial chances for all.

True Identity

At Empower Credit Bureau, we strive to establish trust and identity in the digital world. Our advanced facial recognition technology, coupled with AI-driven fraud detection methods, ensures secure and seamless onboarding of customers on our platform. With comprehensive identity cross-validation, we can efficiently detect and prevent any fraudulent activities while enabling safe and secure transactions. Join us on this journey toward a trustworthy and inclusive financial ecosystem.

Additional Services

Tailored Credit Solutions

Our first additional service offers credit access and lending solutions tailored to the specific needs of the unbanked and underbanked populations, ensuring equal financial opportunities for all. Working with banks and lending institutions, we provide a more accurate picture of an individuals or organizations ability to access financial instruments

Credit Counseling and Financial Education

Our second additional service allows clients to access credit counseling and financial education, empowering them to make informed financial decisions and improve their creditworthiness.

Credit Monitoring and Identity Theft Protection

Our third additional service provides credit monitoring and identity theft protection, giving our clients peace of mind and security in their financial transactions.

FAQ's

Objective of Empower Credit Bureau

We provide credit access to both unbanked and underbanked individuals and businesses in Nigeria.

Credit Access

Unlike other traditional credit bureaus we offer comprehensive and accurate credit reports based on alternative data sources and traditional financial information.

Comprehensive Credit Reports

Our objective is to foster financial inclusion by extending credit access to the unbanked and underbanked populations in Nigeria.

Fostering Financial Inclusion

With a deep commitment to developing comprehensive and accurate credit reports for a broader spectrum of individuals and businesses.

Contact us today.

Contact us today to learn more about how we can help you establish and access credit. Our team is dedicated to providing personalized solutions to meet your unique financial needs, and we are committed to empowering you with the tools to achieve your financial goals.